Consumer prices in the United States rose by 0.4% in December, marking the fastest monthly increase since February. This news complicates the Federal Reserve’s ongoing efforts to curb inflation, raising questions about the effectiveness of its monetary policies.

What is the CPI?

The Consumer Price Index (CPI) measures the average change over time in the prices paid by consumers for goods and services. When we talk about CPI rising, it usually means that things like food, gas, and other everyday items are becoming more expensive.

Fastest Monthly Increase in Almost a Year

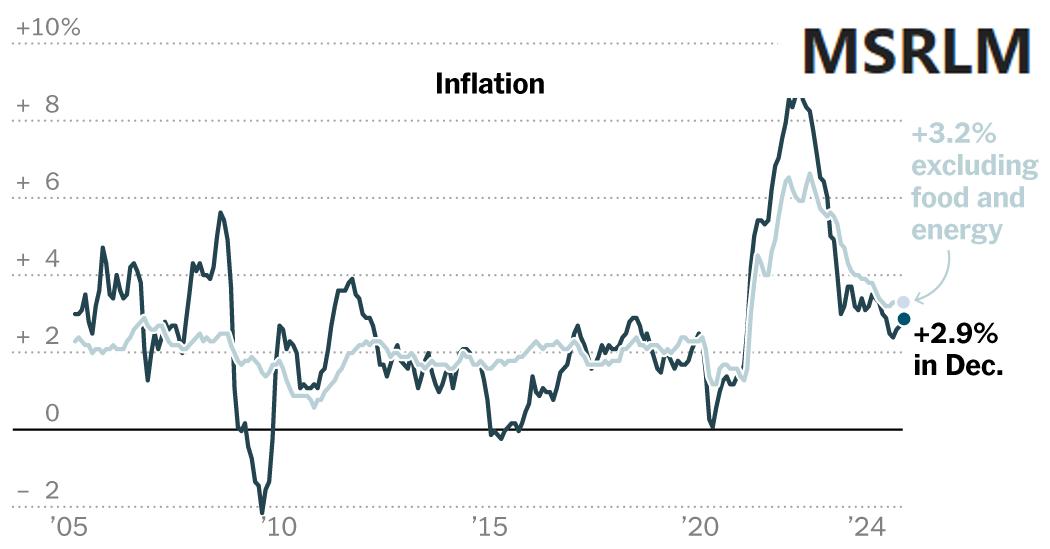

During December, the CPI jumped 0.4 percent compared to the previous month. That sounds a little confusing, but it’s important because it’s the most significant rise we’ve seen since February. When we compare it to December of last year, prices climbed 2.9 percent. This increase is partly due to higher costs for groceries, especially eggs, which have seen notable price hikes.

Core Inflation Shows Mixed Signals

Core inflation, which excludes food and energy prices (because those can be really erratic), increased by 3.2 percent over the year. Interestingly, this number is a bit lower than in the earlier months of 2023. It shows that while some prices are rising, there might be other areas where price growth is slowing down.

How Does This Affect Us?

When prices go up like this, it can change how families budget and spend their money. If consumers have to spend more on basic needs like food, they might have less to spend on other things, like fun activities or new clothes. For some families, this means tighter budgets and careful planning.

Federal Reserve’s Challenge

The Federal Reserve, which is responsible for managing the country’s money supply and interest rates, has been working hard to control inflation. Its main tools include changing interest rates and using various economic policies. However, with prices still rising, many wonder if their strategies are working effectively. The Fed’s job is to keep inflation low—around 2%—so when prices outpace that, it can lead to concerns about the overall economy.

Recent Progress in the Inflation Battle

Interestingly, inflation has significantly cooled since it peaked above 9% in mid-2022. That means while some prices are still climbing, the overall trend is getting better. However, events like this December spike leave economists scratching their heads and wondering what will come next.

Table of CPI Changes

| Month | Monthly Change | Yearly Change |

|---|---|---|

| December 2023 | 0.4% | 2.9% |

| November 2023 | 0.3% | 2.5% |

| October 2023 | 0.2% | 2.3% |

Looking Ahead

As we move into the new year, how will this CPI data impact the steps the Federal Reserve takes? Will there be changes to interest rates? It’s easy to feel overwhelmed by all these numbers, but these decisions affect the economy and your everyday life. Let’s keep watching what happens and how it impacts everything from our grocery bills to our savings accounts.