The South Africa Inflation Rate 2024: Future and History of Inflation Rates is something you will learn about in this article. Everything We Know. The total increase in the cost of goods and services in an economy over a given period, usually a year, is known as inflation. South Africa’s inflation rate hit 5% in 2024. Forecasts from organizations like the South African Reserve Bank and economic analysts serve as the basis for the predicted or actual average increase in the pricing of products and services in South Africa. Continue reading this article to learn more about the South African inflation rate in 2024, as well as past and forecast inflation rates.

South Africa Inflation Rate 2024

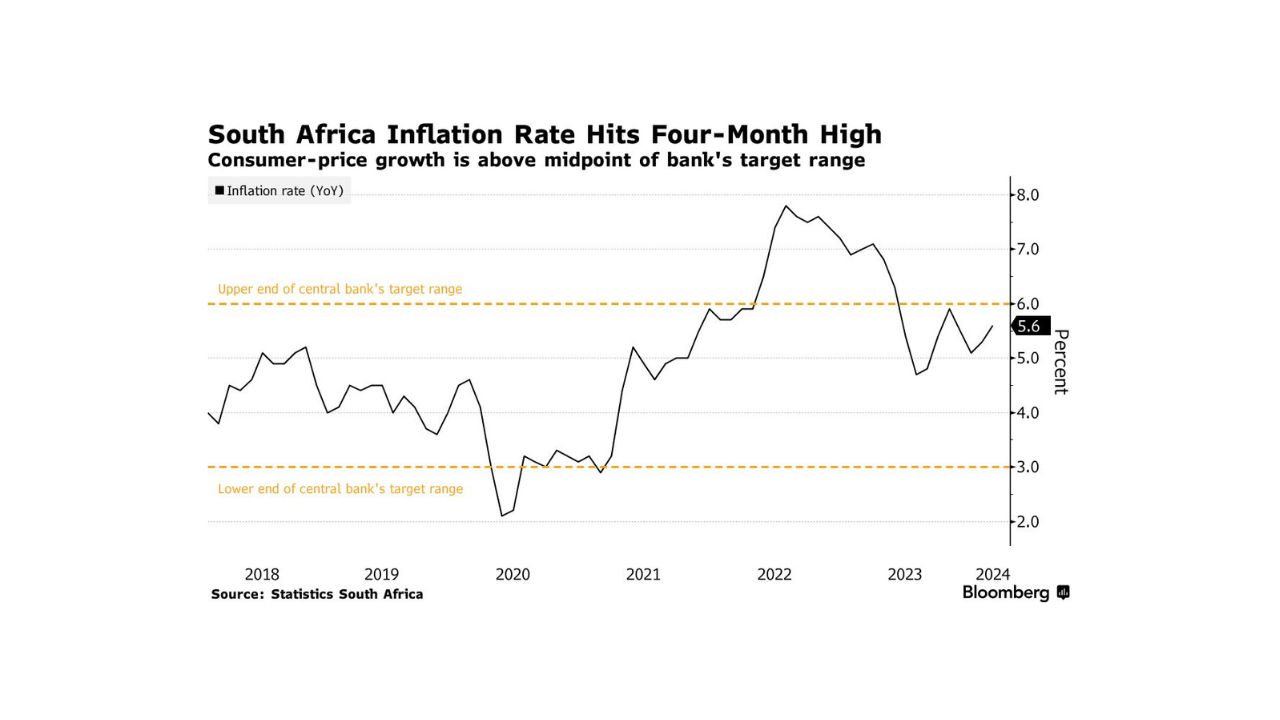

Inflation in 2024 has increased somewhat year over year thus far, hitting 5.6% in February. Food prices are growing by approximately 5.7% as a result of both global and possibly local shortages. The majority of economists and the South African Reserve Bank anticipate that inflation will decline in 2024 and end up at about 5%. As of right now, the rate of inflation has increased a little each year to 5.6%.

In 2024, the high South African inflation rate of 5.7% is predicted to persist, which could fuel inflation. An average of less than 1% is predicted for the inflation of fuel prices. Global and local shortages are to blame for the rising cost of food; as a result, increased government or consumer spending puts pressure on finite resources, pushing up prices.

Future And History Of South Africa Inflation Rate

According to analysts and the South African Inflation Rate Reserve Bank, inflation will decrease in 2024 and end up at about 5%. Thus far, there has been a minor increase in inflation; in February 2024, it was 5.6% as opposed to 5.3% in January. The average rate of inflation in 2023 was 6%, which was lower than the rate in 2022 when it peaked at 6.87%. In recent years, the South African inflation rate ranged from 3.2% to 6.9%, but it was mostly steady in 2022.

Inflation is predicted to level down in the next few months of 2024 and beyond, hovering around 4.5% in the next years. The real inflation rate can be affected by several factors, including government policies, exchange rate fluctuations, and global economic uncertainty. In addition, food costs in South Africa are predicted to stay high in 2024 at about 5.7%, which could have an impact on overall inflation. The increase in fuel prices is managed to be less than 1% on average.

All We Know

The inflation rate for South Africa in 2024 is predicted to be 5.6% in February and to drop to 5% by the end of the year. The Consumer Price Index (CPI) is used in South Africa to calculate inflation. The CPI monitors changes over time in the average cost of goods and services that South African households usually buy.

Food costs are predicted to rise by 5.7% as a result of inflation. This might be caused by more government or consumer spending, which would strain available resources and boost prices. Your Rand loses purchasing power due to inflation. Anything that cost 100 Rand in 2023 would cost 105 Rand in 2024 due to a 5% inflation rate.

The Bottom Line

The South African Reserve Bank may increase interest rates to combat inflation. As a result, borrowing may become more costly for both individuals and enterprises. High inflation can also deter investment since returns might not keep up with price increases. Low-income households can be disproportionately affected because they spend a lot of their income on necessities. Changes in the price of oil or recessions in other nations can affect the import and export of South Africa.

Changes in the exchange rate can also impact the cost of imports and lead to inflation. Additionally, decisions about taxes, interest rates, and spending can have an impact on the supply and demand within the economy. The 2024 South African Inflation Rate is a complicated problem with many underlying causes and consequences. Forecasts indicate a decline in 2024, although the actual pace may vary depending on several factors. Nonetheless, the South African Reserve Bank expects inflation to reach 4.6% by 2025, continuing its declining trajectory.

The predicted decrease in inflation over the next few years is consistent, with a potential stabilization of around 4.5%. Many factors, including exchange rates, federal government policies, and global economic conditions influence the actual rate of inflation. These factors reduce your purchasing power and may lead you to focus on investments. Also, the investments can exceed inflation within a target range of 3% to 6% to support economic stability.

Important Links