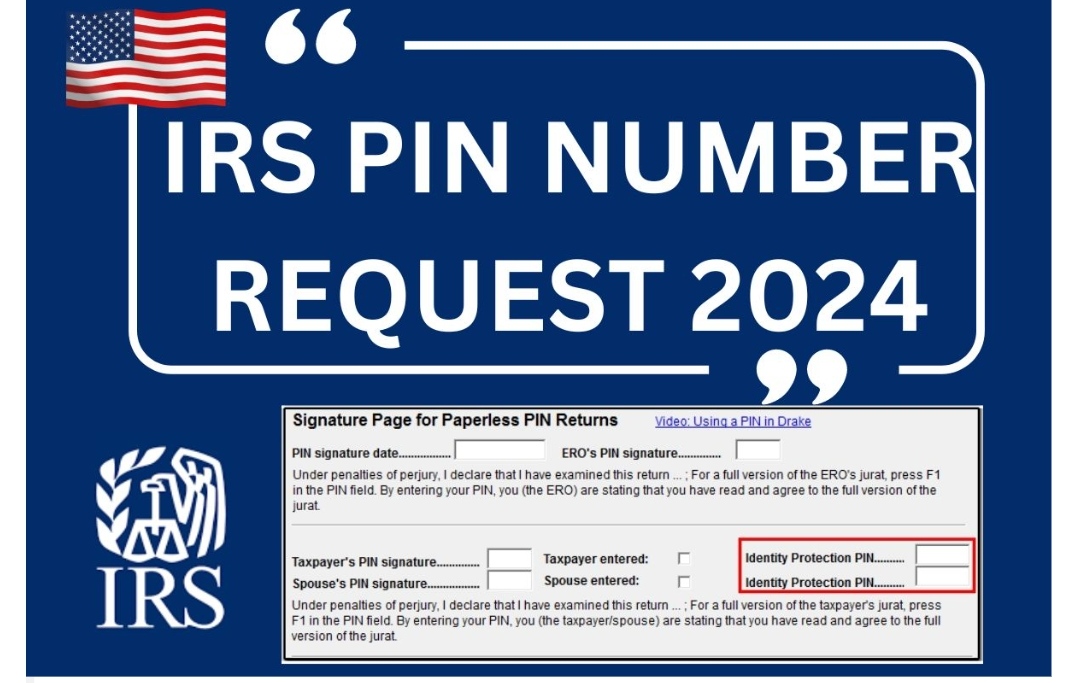

An Identity Protection PIN, a six-digit number, is a service offered by the Internal Revenue Service.

It prevents another tax payer from filing a tax return using your Social Security number or Individual Taxpayer Identification Number. The IRS and you alone will be aware of the IP PIN.

You can use this IP PIN to authenticate yourself while submitting your tax return electronically or on paper. Even if there are no filing requirements, your account will still be protected by the IP PIN.

Your CP01A Notice and new IP PIN will be mailed by the IRS each year if it is determined that you were the victim of tax identity theft and the matter has been rectified.

If you are confirmed a victim of theft related to tax identity and the issues have been resolved IRS will mail you CP01A Notice with new IP PIN each year.

Your CP01A Notice and new IP PIN will be mailed by the IRS each year if it is determined that you were the victim of tax identity theft and the matter has been rectified.

You will receive an IP PIN if you do not already have one as a precaution against theft related to taxes. Anyone with an SSN or ITIN, even those who reside overseas, can obtain an IP PIN.

You must successfully complete the identity verification process in order to request an irs.gov Identity Protection PIN for 2024.

IRS IP PIN 2024

| Post title | IRS PIN Number Request 2024 |

| Organization name | Internal Revenue Services |

| PIN Name | Identity Protection PIN |

| Total digits | 6 digits |

| Request through | Online mode |

| Motive | Not to let others file return using their SSN |

| Post type | Finance |

| Website | irs.gov |

The Identity Protection PIN will be given to the individuals so that no one can use their Social Security number to file taxes.

The six-digit IP PIN is given to each individual and is only known by the IRS and the taxpayer. Obtaining an IP PIN requires completing an identity verification process.

Using the online IP PIN tool is the quickest method to obtain an IP PIN. To obtain the IP PIN, go to irs.gov.

How To Get An IP PIN 2024

1. Using the online Get an IP PIN tool is the quickest way to obtain an IP PIN.

2. Use your device to navigate to irs.gov. Select Obtain an IP PIN for your gadget.

3. If you have an account, use ID.me to log in. If you don’t already have one, click Create an Account.

4. After providing the requested information, your IP PIN will be generated.

Crucial Information About IP PIN 2024

1. IP PINs are only good for a single year. Your account generates a new IP PIN annually.

2. Your current IP PIN will be displayed when you log in to obtain a toll.

3. Use of the IP PIN is required when filing a federal tax return.

4. The paperwork is required to create intellectual property.

Documents Required to Get IRS PIN 2024

To establish their identity, applicants must present one photo ID document issued by the government currently in circulation in addition to other identifying documents.

How to Get Your 2024 IP PIN Back

1. To find their current IP PIN, one might use an internet service for IP PIN retrieval.

2. If you don’t already have an account on irs.gov, you will need to verify your identity and create one.

3. You must obtain an IP PIN and log in to your account if you have created an online account and received an IP PIN.

4. For a number of account security reasons, you will need to authenticate yourself once more.