The citizens of the USA are subject to income tax on any money they earn, regardless of how it was earned. Because income taxes are progressive, your payment will vary according to your income.

Additionally, there is an exemption from this income tax. Some states exempt certain states from filing any tax returns. The desire of the populace is always to pay less in taxes, and being in a state with no income tax allows for this to occur.

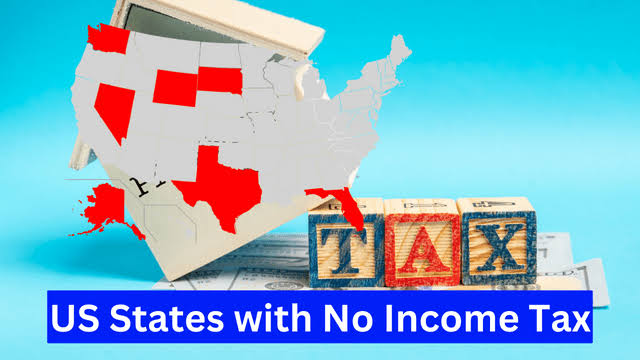

The states included on the USA States List With Zero Income Tax 2024 are Alaska, Nevada, Tennessee, Florida, Texas, Washington, South Dakota, Wyoming, and New Hampshire. These states do not impose income taxes.

USA States With Zero Income Tax 2024

The investment as well as interest income are supplied by Washington and New Hampshire. States without income taxes generate little money and cut back on services. The zero earnings tax rate is determined by a number of factors, including employment and healthcare opportunities.

The criteria for states with no income tax will fluctuate as long as the law does. States without an income tax will still have to pay taxes. However the amount varies from state to state.

Individuals residing in these states will not be required to pay retirement income taxes. But, they will not be able to fully benefit from state and local tax deductions. You should read the article below to learn more about the states that do not impose income taxes.

Alaska

In Alaska, there is no sales tax or income tax; instead, residents are subject to a 5.06% local sales tax, property tax, and income tax. The payment is made by the Alaska Permanent Fund Corp. to the citizens.

Florida

The state levies no income tax, its excise tax is higher than the federal average, and the overall tax burden is 6.33%.

Nevada

The state depends on the money raised by the sales tax, which applies to everything from food to clothing. The state is required to bear a 7.69% tax burden. The state often spends very little on healthcare.

Texas

To pay its expenses, the state depends on sales revenue and excise taxes. The state has the highest property taxes in the country, while the lowest are in this particular state. The majority of the funds are used on education and healthcare.

South Dakota

The state taxes both alcohol and cigarettes, yet only 6.69% of the individual income tax is paid by the state. The state is ranked eighth in terms of affordability and twelveth in terms of US Best States. In comparison to other states, the state invests less on healthcare and education overall, although spending more on both.

Washington

In this youthful state, only sixteen percent of the population is older than sixty-five. In addition to the high cost of petrol in the state, residents must pay significant sales and excise taxes. The state’s tax burden is 8.24%, with virtually little going towards education and healthcare.

New Hampshire

The only taxes levied by the state are dividends and interest; there is no sales tax; only excise tax applies. The state is ranked third and has spent the most money on education overall, with a tax burden of 6.14%.

Tennessee

Those who rely on investment income are drawn to the state. The state has the fourth-lowest tax burden in the nation, at 6.22%. Compared to other states, the state spends the least on healthcare and education.

Wyoming

This state, which is the second least populous in the union, maintains exceptionally low sales tax rates and exempts its residents from paying any personal or income taxes or retirement income taxes.